Work from house work does not necessarily suggest that you are a staff member.

As with all jobs, you may be classified either as a worker or an independent professional (self-employed).

When you are examining chances, be sure to consist of employee category as one of the deciding factors.

Employee classification is a complex subject that spans employment, tax, and labor laws and can cause steep penalties for business that don’t categorize employees properly.

For you, it comes down to which circumstance will much better match your goals.

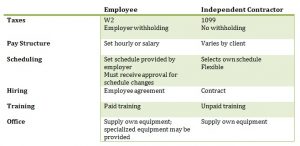

For starters, let’s discuss the standard distinctions between workers and independent specialists.

You are straight on the company payroll if you’re a worker. Your employer withholds federal and state taxes, and withholds and pays Social Security, Medicare, and joblessness taxes on your wages.

You are likely offered benefits (such as paid vacation and medical insurance). and you get a Kind W2 each year from your employer detailing the taxes kept from your pay throughout the year.

If you’re an independent contractor, instead of an employer you have a client (or customers). Considering that you are in fact self-employed under this status, there is no withholding and you are responsible for paying your own taxes and offering your own benefits.

You get a Type 1099 each year from your customers detailing what you were paid during the year.

Per the IRS, the following three categories help figure out worker category

- Behavioral: Does the business control or deserve to control what the worker does and how the employee does his/her job?

- Financial: Are business elements of the employee’s job managed by the payer? (these consist of things like how worker is paid, whether expenditures are repaid, who supplies tools/supplies, etc).

- Kind of Relationship: Exist written contracts or worker type advantages (i.e. pension, insurance, getaway pay, etc)? Will the relationship continue and is the work carried out an essential element of business?

What does this mean for you?

Compare work from home work alternatives (click for larger image).

The factors that will affect you most when considering work from home work or contracting are

Pay Structure

Staff members typically receive a set hourly wage or income while independent contractors may be paid by the job or task.

Specifically in tasks where workers may perform call center functions, it is not uncommon for independent contractors to be paid either per hour, per talk minute, or per call. Only employees are entitled to base pay and overtime pay.

Scheduling

In general, staff members work a set schedule determined by their company while independent professionals normally pick their own schedules.

In some positions, especially call center work, contractors might be needed to work a particular quantity of hours weekly, but it is left to their own discretion to choose the hours to fulfill the requirement.

Call center specialists might deal with an readily available hours basis where they log-in to the contracting business’s scheduling system to select their hours on set days and times when the schedule is launched. Depending on the customer, it may be hard to record a full-time schedule as specialists are completing with others for the readily available hours on the schedule.

Be mindful of this possibility if you are interested in a call center job and looking for a complete time schedule.

Set up adherence for call center work tends to be more versatile for professionals. If a professional finds that they can not adhere to the schedule that they selected, there is normally a system to release hours to someone else who works the same project, where an employee normally does not have this option.

Hiring

Workers might sign a staff member agreement, but independent professionals generally sign a contract detailing the terms and scope of their assignment. A contract will list all specifications for the job or job, consisting of the duration of the contract. Long-term contractors will generally sign a brand-new contract on an annual basis.

Though specialists are self-employed, formation of a main service entity is typically not a requirement.

Training

Employees can depend on paid training. Independent professionals, depending upon the nature of their tasks, may not get training or if they do, they usually will not be made up for the training duration.

Office

Companies normally supply all the required devices to their staff members for performing task functions.

Work from house employment is an exception. In many cases, employees are anticipated to provide their own totally geared up office. Some companies will provide equipment. .

These are basic guidelines for work from house employment and though they apply in a lot of circumstances, there may be variations. Treatment of staff members and specialists may be different from one company to the next so it is always best to research the chances that you have an interest in.

Which Is Best?

Deciding between work from house employment and contracting is just a matter of weighing each against your goals. Consider how each option impacts you.

If you are interested in call center work and the company you prefer only works with independent specialists paid per active talk minute, that suggests that for every second that you are not on a call, you are not being paid.

On the other hand, your schedule will be entirely under your control. Which is more vital for you?

Speak with a tax expert to ensure you understand how being an independent contractor will impact your taxes.

More Job/Career Ideas & Resources

What are you most interested in– work from house employment or contracting?

Article source: https://www.realhomejobsnow.com/work-from-home-employment/