While lots of individuals believe that an accounting degree uses a particular career path, this understanding is far from precise. The abilities that accounting majors are taught in college– finance, interaction, bookkeeping, stats and mathematics– prepare them for a variety of professions in business and government. Lots of accounting majors might pursue conventional careers in accounting and auditing, however there are a lot of alternative career paths for graduates and students going to explore other options.

Here is a list of 12 jobs for accounting majors:

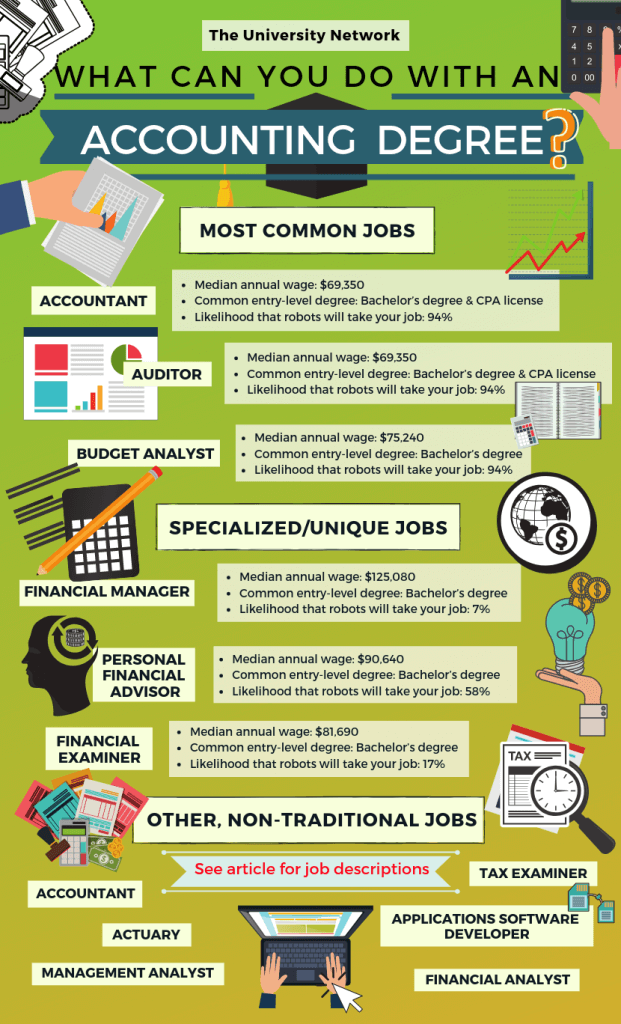

A Lot Of Typical Jobs for Accounting Majors

1. Accounting professional

Accounting professionals keep track of, analyze and archive a company’s financial information. After finishing a bachelor’s degree, aiming accountants must end up being state-certified by passing the Licensed Public Accounting Professional (Certified Public Accountant) examination, which is administered by the American Institute of Licensed Public Accountants.

Mean yearly wage: $ 69,350.

Typical entry-level degree Bachelor’s degree & & Certified Public Accountant license.

Likelihood that robots will take your job 94%.

2. Auditor

Auditors evaluate the monetary accounts of companies to guarantee compliance with guidelines and internal policies. External auditors are employed by accounting or auditing firms, and are brought in by customer companies to examine their financial records on event. A bachelor’s degree in accounting is normally needed to end up being an auditor.

Typical yearly wage $ 69,350.

Common entry-level degree Bachelor’s degree & & CPA license.

Likelihood that robotics will take your task 94%.

3. Budget Expert

Budget plan experts assist all kinds of companies– companies, governments, universities, and so on– on the management of their financial resources. They work along with management to produce budget plan reports and review spending plan propositions. They carry out cost-benefit and other analyses of programs, and assess financial demands and funding methods. Based upon their conclusions, they provide budget plan and financing suggestions to management, administrators, or lawmakers, however they typically do not make the last contact monetary choices. Furthermore, they are accountable for ensuring that budgets abide by laws and policies. A bachelor’s degree in accounting or a related topic is usually required to end up being a budget expert.

Median yearly wage $ 75,240.

Typical entry-level degree Bachelor’s degree.

Probability that robotics will take your job 94%.

Unique/Specialized Jobs for Accounting Majors

4. Financial Supervisor

Financial managers are accountable for supervising a company’s monetary plan and ensuring its overall monetary stability. They develop and examine financial reports, develop financial forecasts, and devise strategies to improve their company’s monetary health. They examine markets and look for brand-new opportunities for development through investments, mergers, acquisitions, or other methods. They are also accountable for overseeing the company’s financial reporting and budgeting staff. Becoming a monetary manager needs a bachelor’s degree and a minimum of five years of experience in a lower-level financial position, such as an accounting professional or monetary expert. Companies might look for prospects with an advanced degree in a field related to finance.

Average annual wage $ 125,080.

Typical entry-level degree Bachelor’s degree.

Likelihood that robots will take your job 7%.

5. Personal Financial Consultant

Personal financial advisors deal with clients to discuss and satisfy their financial objectives, offering guidance on anything from investments to home mortgages to retirement funds. A bachelor’s degree in accounting is typically sufficient to acquire entry into the field. Depending upon your role in the company you work for, and especially if you are associated with trading stocks and making financial investments, you might require licensing and accreditation from the Securities and Exchange Commission.

Median yearly wage $ 90,640.

Common entry-level degree Bachelor’s degree.

Possibility that robotics will take your task 58%.

6. Financial Examiner

Financial inspectors review the finances and deals of monetary companies to ensure compliance with laws and examine the financial health of the organization. They are accountable for assessing the level of risk in loans and deals and keeping an eye on loaning activity to ensure and safeguard debtors that lenders do not use predatory loans. Financial inspectors might work within monetary or insurance companies or in the state and federal government. Financial inspectors have to remain current with new regulations and develop organizational policies to secure these policies. A bachelor’s degree is needed for work as a financial inspector.

Median annual wage$ 81,690.

Typical entry-level degree Bachelor’s degree.

Likelihood that robots will take your task 17%.

Non-Traditional Jobs for Accounting Majors

7. Actuary

Actuaries use mathematics, statistics, and financial details and theory to assess the financial expenses of risk and unpredictability. Actuaries work for a range of businesses, and they are vital positions at financial consultancies, insurance coverage firms and banks. A bachelor’s degree in any field associated to fund or service, consisting of accounting, is generally all that’s needed to go into the market.

Typical annual wage $ 101,560.

Common entry-level degree Bachelor’s degree.

Likelihood that robots will take your task 21%.

8. Management Analyst

Management experts, also referred to as management specialists, evaluate an organization’s management structure and offer recommendations about how it can be enhanced to make the company more lucrative or efficient. Management experts develop in-depth research study reports that take into consideration a company’s structure, the experiences and viewpoints of personnel, and monetary records. They then suggest modifications to the organization’s structure or operation with the objective of improving the organization’s overall operation. While accounting majors do not normally pursue careers in management consulting, a degree in accounting provides an excellent foundation for a management consulting profession. Management specialists regularly work along with the accounting professionals and monetary managers, and need to have a strong understanding of finance and service to succeed. Positions as management experts are open to candidates with bachelor’s degrees, although most experts have previous work experience in management positions. Some employers might seek out candidates with master’s degrees.

Mean annual wage $ 82,450.

Common entry-level degree Bachelor’s degree/Master’s degree.

Probability that robotics will take your task 13%.

9. Softwares Developer

Accountants and other monetary employees are increasingly reliant on computer system software to help them in arranging and examining financial information. A bachelor’s degree will typically qualify most prospects for entry-level software application advancement positions.

Median yearly wage $ 101,790.

Common entry-level degree Bachelor’s degree.

Probability that robots will take your task 4%.

Other Jobs for Accounting Majors

10. Tax Inspector

Tax examiners are used by government tax authorities, such as the Internal Revenue Service, to review tax returns and carry out audits. In short, they are accountable for ensuring that individuals and organizations are paying their taxes correctly. This involves confirming that taxpayers are reporting financial information precisely which any reductions or tax credits claimed are done so within the parameters of the law. When tax examiners find that a private or company has underpaid, they contact the taxpayer and concern charges, interest, or charges. Also, if they find that a taxpayer has actually overpaid, they will provide refunds. A bachelor’s degree in accounting or a related field is usually required to become a tax inspector.

Typical annual wage $ 53,130.

Common entry-level degree Bachelor’s degree.

Probability that robotics will take your job 93%.

11. Financial Analyst

Monetary experts are accountable for examining monetary data in order to supply details and assistance to companies or individuals on company and investment decisions. They are utilized within the financial market by investment banks and companies and outside of the monetary industry by smaller banks, insurance companies, and property brokerages. Monetary experts will take a look at trends in the market and specific companies’ statements to put together investment recommendations. Financial analysts usually need to have a bachelor’s degree in any field related to finance or organization, consisting of accounting.

Mean yearly wage $ 84,300.

Common entry-level degree Bachelor’s degree.

Probability that robots will take your task 23%.

12. College Teacher

Due to the fact that an accounting degree is an expert degree, many accounting professors have actually previously worked as an accounting professional before transitioning into academia. In order to become a college professor, you will need at least a master’s degree and perhaps a doctorate.

Typical annual wage $ 100,270.

Typical entry-level degree Master’s degree/Ph. D.

More Job/Career Ideas & Resources

Probability that robots will take your task 3%.

10 Famous Individuals Who Studied Accounting

- Arthur Blank, business owner.

- Cris Collinsworth, sports expert & & previous football gamer.

- Kenny G, artist.

- John Grisham, novelist.

- Gibby Haynes, artist.

- Phil Knight, business owner.

- Chuck Liddell, Mixed Martial Arts fighter.

- Bob Newhart, comedian.

- Ray Romano, comedian and star.

- Julia Sweeney, comic.

Article source: https://www.tun.com/blog/12-jobs-for-accounting-majors/